DCA Trading Strategy And Guide To Create DCA Bot

DCA bots are cryptocurrency trading bots that trade based on the Dollar Cost Average (DCA) trading strategy. DCA trading is an investment strategy that aims at minimizing losses in a high volatility market, such as trading cryptocurrencies.

The strategy works by placing extra safe orders in opposite side of the market to make better average entry price. DCA bots simply work by enabling automated trading of the DCA strategy.

How Does The DCA Bot Strategy Use And Work

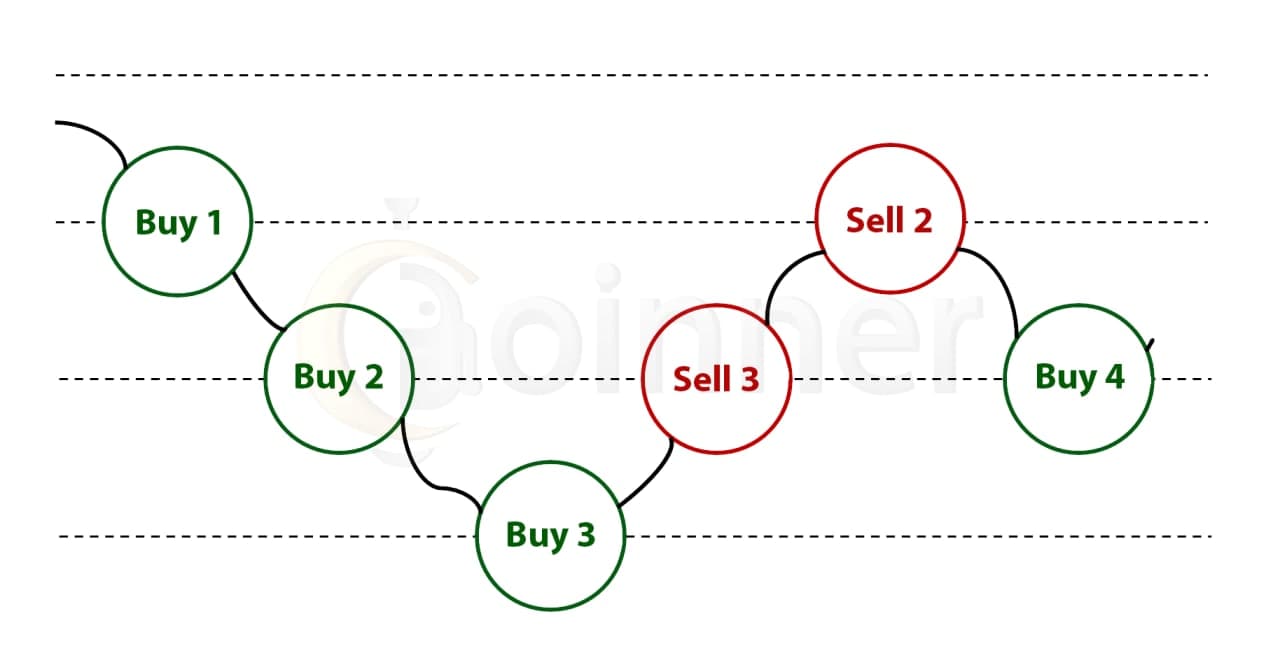

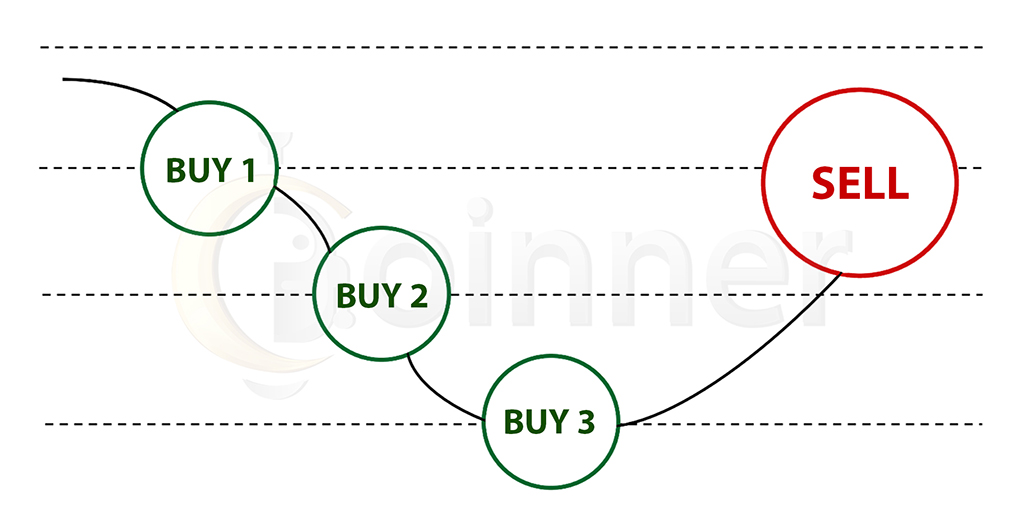

When you activate the bot, the first move is placing the First Order. Let's take “Long bot” as an example where first order is a Buy Order. Immediately the first is executed, the bot will place a Take Profit Sell Order and extra buy orders based on the First Order's price execution.

If the token price dropped, extra safe orders will fill and the bot will calculate the average buy price for the total. Then, bot will cancel previous take profit order and create a new take profit order at lower price based on the new average entry. If the price decreased more and another extra order filled, the bot will reduce the Take Profit order price again based on the averaged total buy price. That's how it keeps you within profitable levels. Note: There can only be one take profit order at a time on the exchange.

The price averaging will keep repeating in the subsequent extra orders as long as the price is dropping below the initial buy price. This is to ensure the trader has some good odds to complete the trade with profits. That's how the DCA bot strategy works. Below is a diagrammatical representation of how DCA bots work.

Advantages Of DCA Bots

Main advantage of the DCA trading strategy is enabling the averaging of entry prices. Whether you are using long or short strategy trends, the bot will use extra safe orders and reduce the Take Profit target when the price goes in the opposite direction. In most cases, when the token price/value drops. This protects you from sustaining losses for an extended trading period.

Even if the token value drops and never returns to the initial value you entered with, the DCA strategy will still find you an opportunity to complete the deal in profit by reducing take profit target.

Another advantage of using DCA bots is flexible settings. Users can decide custom price gap between extra orders and size of extra orders.

Further, helping reduce the emotional pressure of investing all assets at a single price is another advantage. Emotional pressure is the biggest cause of loss in cryptocurrency trading. The automated extra orders at an average price ensure your bids are better even in a highly volatile market.

Step-By-Step Guide To Creating DCA Bot in Coinner

The process of creating a DCA Bot in Coinner platform is simple and free of charge. You don't have to pay any subscription fee to run DCA bots in Coinner platform.

1) Connect an Exchange

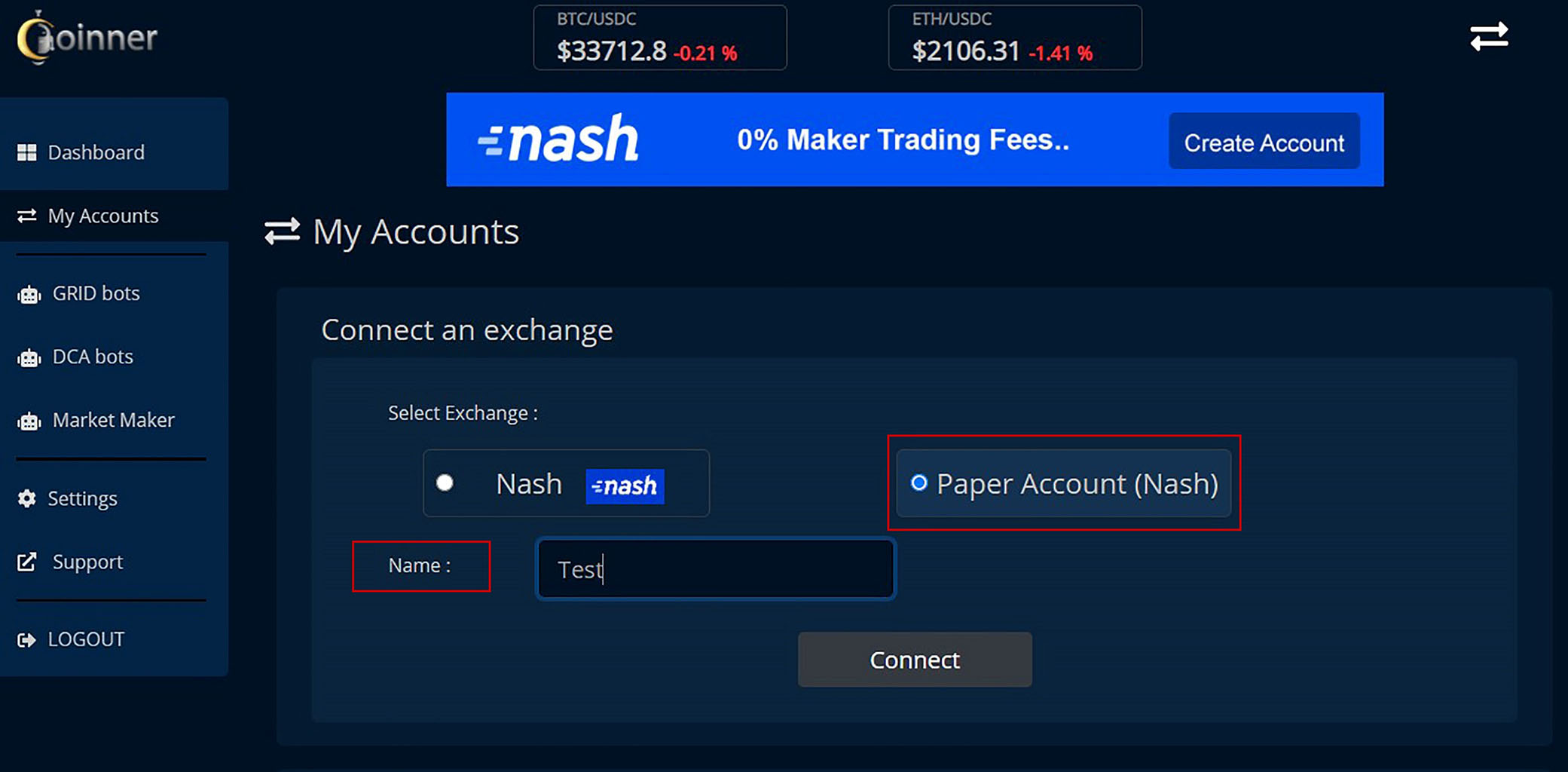

To get started, first you need to connect your exchange account. So go to My Accounts Page, give your account a Name, then you can select an Exchange and connect using API keys.

If you are a newbie, we recommend starting with the Paper Account ( a test account with virtual funds ) without risking your investment. To create a Paper Account, go to My Account and click Paper Account. Then enter the name and connect as shown below.

2) Creating a FREE DCA Bot

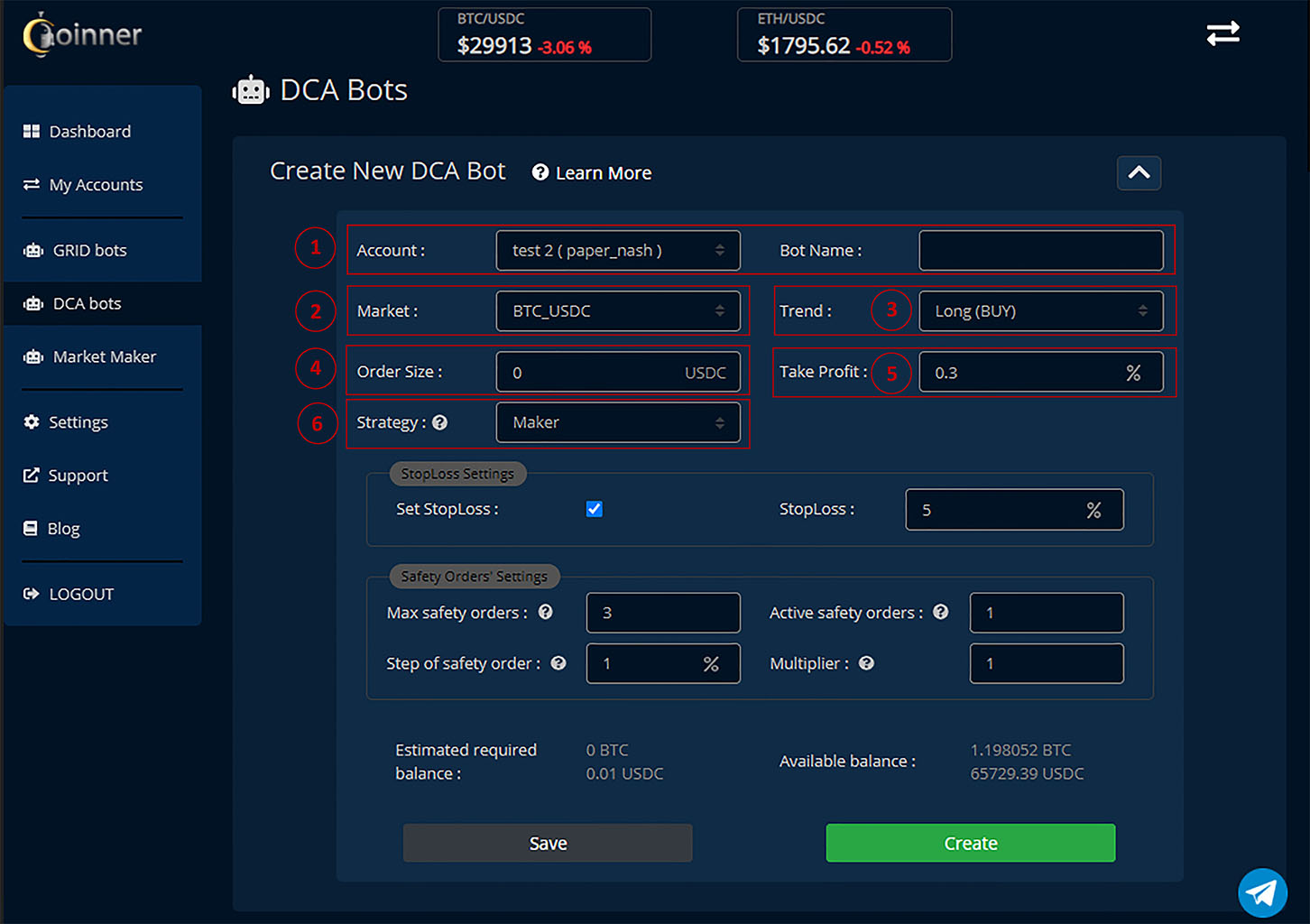

Now, this is how you own a DCA bot in Coinner platform. Go to the DCA bot page, and click the 'Create DCA Bot' button.

Here are the 8 steps for creating DCA Bot in Coinner

1. Select the Account and give a name for the bot

2. Go to the Market section and choose the trading pair for your bot to trade with,

3. In the Trend section, select "Long" or "Short" trend, depending on how you want your DCA bot to work. For the "Long" trend, the bot buys coins at a lower price and sells them at a higher price. For the "Short" trend, the bot will sell at a higher price and buy back at a lower price.

4. Enter the Order Size (Initial Order's Size in quote currency),

5. Enter your prefered take profit percentage.

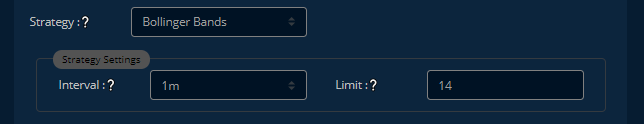

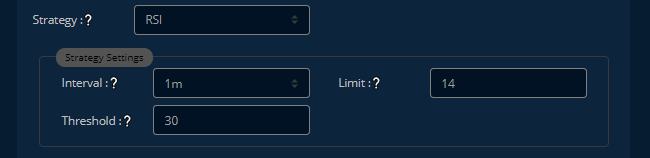

6. The Strategy section represents deal starting condition, you can select it as "Maker" / "Bollinger bands" / "RSI".

"Maker" strategy places order immediately on top of the orderbook. If it filled, the DCA Bot will place the take profit order for that order.

For "Bollinger bands" strategy, bollinger band indicator uses to trigger signals. If the price drops lower than the lower Bollinger band, BUY signal will trigger for "Long bots", and if the price increases and crosses the upper Bollinger band, SELL signal will trigger for "Short bots". You need to set the Time Interval to calculate signals and the Limit, which is the number of candles used to calculate signals.

Similarly, the "RSI" strategy uses RSI indicator to trigger signals. If the RSI value is exiting from the lower threshold range, the bot will place a buy order. If the RSI value is exiting from the upper threshold range, the DCA Bot will place a sell order. You can select Time Interval to calculate signals, the Limit and Threshold, which is the RSI value used to trigger signals. If it is 30, buy signals trigger at 30 for "Long bots", and sell signals trigger at 70 (100-30) for "Short bots".

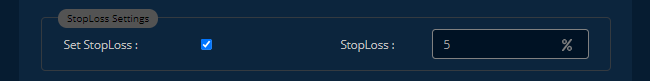

7. Activate Stop Loss for your bot to save you from huge losses if the prices move continuously in the opposite direction. Note: Bot will calculate stop loss level from the initial order price and not from the deal average price.

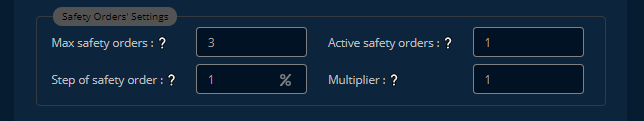

8. Activate Safety Orders options for DCA bots to have a better entry price by averaging cost per coin. This makes it faster to close deals with a profit. This is one of the most important parts of the DCA Bot settings as well as the DCA strategy.

'Safety Order' Option Settings You Should know.

- Max safety orders - the maximum amount of safety (extra) orders that will be executed for one deal.

- Active safety orders - number of safety orders to keep open in orderbook.

- Step of safety order – the price gap between two safety orders in percentage.

- Multiplier - each safety order's order size will multiply by this value.

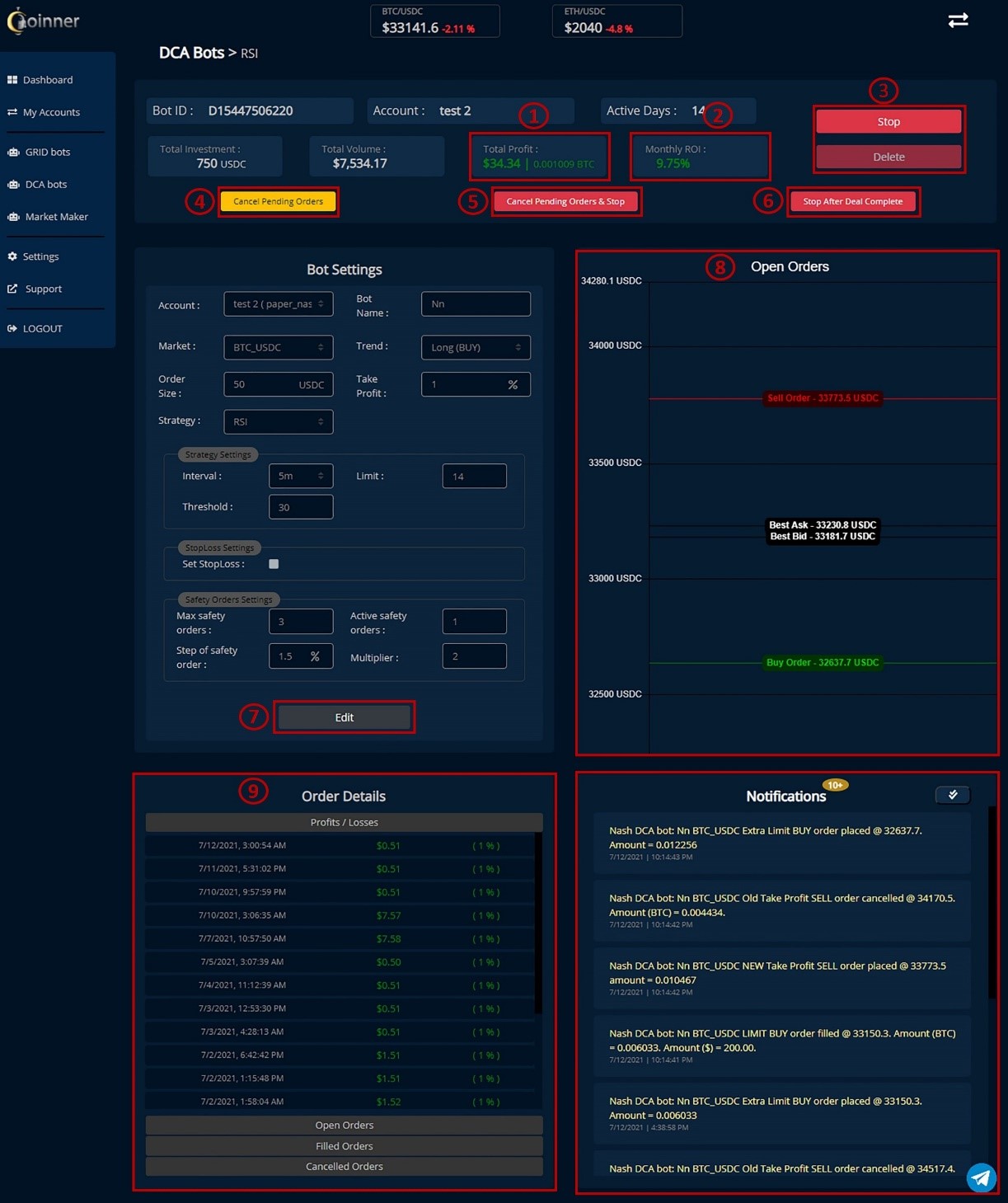

DCA Bot Management

Here are 10 major things you should know about DCA bot management

1. Display the Total Profit since the bot creation date.

2. Display the monthly ROI calculated based on past performances.

3. DCA Bot controls, Stop (pause) the Bot, and delete the Bot.

4. Here you can cancel all the open orders, but the bot keeps running.

5. Here you can cancel your all-open orders & stop the bots.

6. Next, you can let the bot stop after the running deal is complete.

7. You can edit your bot settings anytime, but for few settings, you need to stop bot, and after editing, you should restart bot.

8. A chart displaying currently open orders, best Bid price and best Ask price.

9. Order details - profits & losses, open orders, filled orders, and canceled orders.

10. Bot's notifications. (You can activate notifications through Telegram as well. To activate Telegram notifications head to Settings page and connect with Coinner Telegram Notification Bot.)

Now you know everything to start DCA bot trading in Coinner Platform.

Happy Trading !

Disclaimer: The contents of this article should not consider as financial advice. There is a high-risk associated with cryptocurrency trading. The user must do their own research before investing in cryptocurrencies.