Beginners’ Guide: Grid Bots and Grid Bot Trading

Grid bots are trading bots or robots that are used to carry out a Grid Trading Strategy. It is a trading strategy that makes profits from ups and downs on asset prices or simply a ranging. Grid trading is time-consuming and energy-draining, and that’s why automated trading is highly recommended.

Grid bots are designed to help you automate your grid trading strategies. They have been in forex trading before but recently gained popularity in the cryptocurrency market due to its volatility. You just need to set the range, and the bots will be executing your trading automatically to earn you profits.

Advantages of Grid Bots

There are so many benefits that you get when you trade with grid bots. As mentioned above, you don’t have to do your grid trading manually because these bots will earn you income even while you are sleeping. Here are some of the major advantages of grid bots:

1. Reliable Trading Strategy

If you are trading crypto using the grid strategy, a grid bot is the most reliable and trustworthy tool to use. The cryptocurrency market is one of the ranging markets, where prices constantly move up and down. With a grid range set, these bots will ensure that you are buying and selling at a profit. Therefore, a profit from your grid trading is a guarantee.

2. Ease to Use

Whether you are a newbie or a pro, it does not matter. Grid bots are pretty easy to use since you don’t need to learn algorithms or complicated market signals. All you need is to understand basic things, such as setting the ranges for the cryptocurrency you want to trade, and that’s it.

3. Versatility in Use

As mentioned above, grid trading bots are designed to buy low and sell high. That’s how they work. Therefore, they are not designed for any specific crypto coin, and this means you use them on all assets that can be traded using the grid trading strategy. The basics are the same, and you don’t need to learn anything new when switching from one trading asset to another.

4. Improved Risk Management

Trading with grid bots helps to reduce the risk of making losses. The software program will always ensure that it has bought the cryptocurrency at a lower price and sell it at a higher price. Without this condition satisfied, a transaction cannot be executed. That’s how losses are reduced.

How Does The Grid Bot Strategies Use And Work

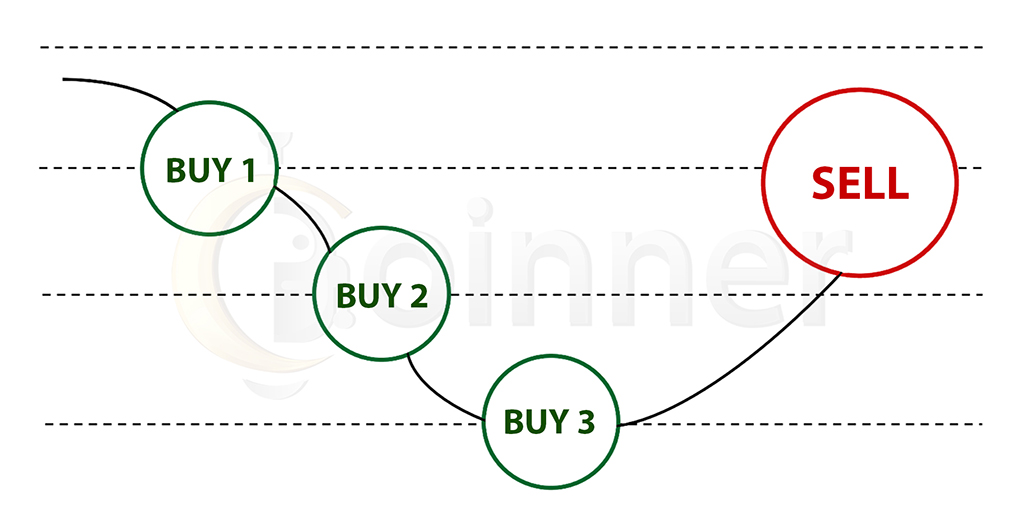

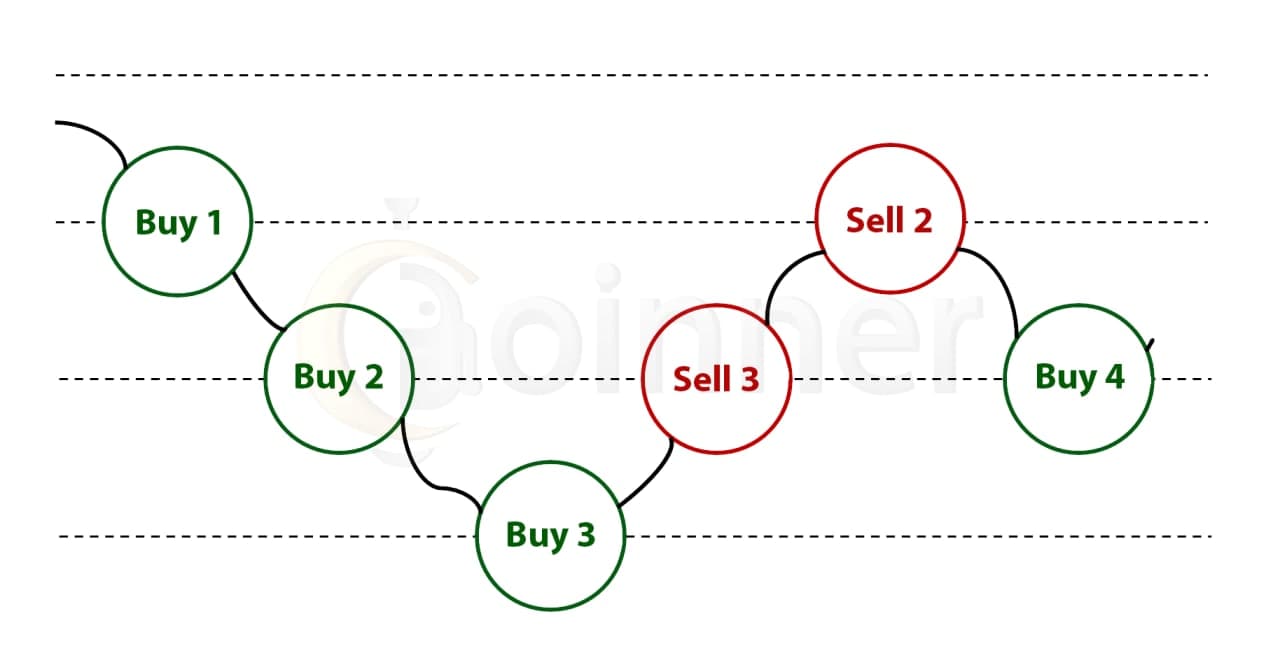

The grid bot strategy is the use bot to perform automated grid trading. It is a trading strategy where the trader sets upper and lower price ranges and the number of orders they want to place within the grid. The bot is then activated to execute automated trading. If a buy order is executed, the bot will immediately place a sell order at a higher grid and vice versa. The number of orders is always maintained as set by the trader. That’s how these bots work. Below is a graphical representation of how grid bots work:

Step-By-Step Guide To Creating Grid Bot In Coinner Platform:

If you want to enhance your cryptocurrency trading, automated trading with Coinner grid bots would be the best decision you can make. Coinner platform is making it very easy for any crypto asset trader to create a grid bot free of charge and start making profits immediately. Here are easy steps on how to create a grid bot in Coinner platform.

1) Connect an Exchange

To get started on Coinner, first you need to connect to your exchange account. So go to My Accounts Page, give your account a Name, then you can select an Exchange and connect using API keys.

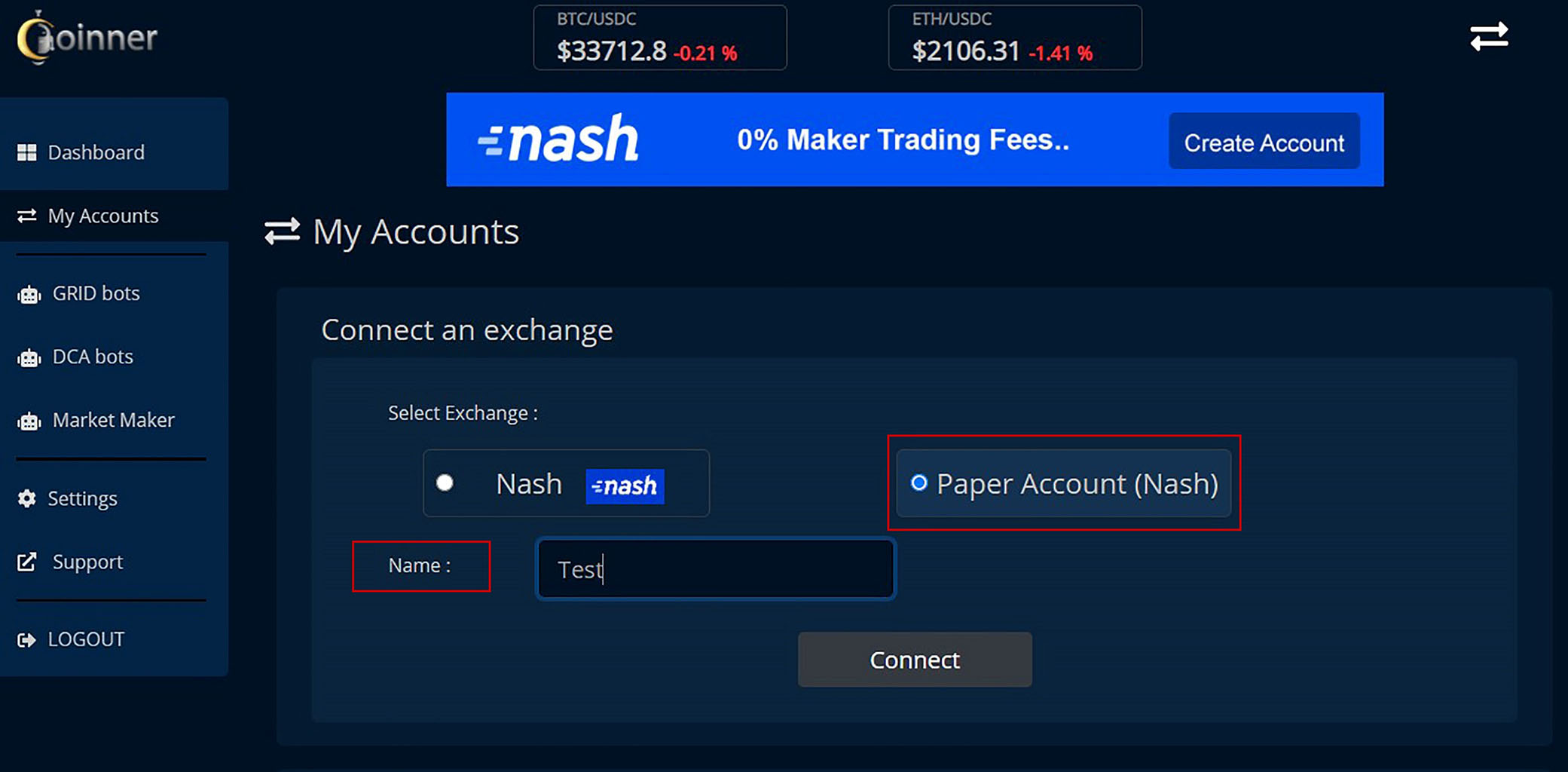

If you want to test without any risk, you can use Paper Account. Here are the steps for creating a ‘paper account’

1. Go to ‘My account’ and click “Paper Account.”

2. Enter name and click “Connect.”

With that, you have an account and can now proceed to the next step of creating the bot. Below are the steps to follow in Coinner to create a grid bot.

2) Creating A Grid Bot

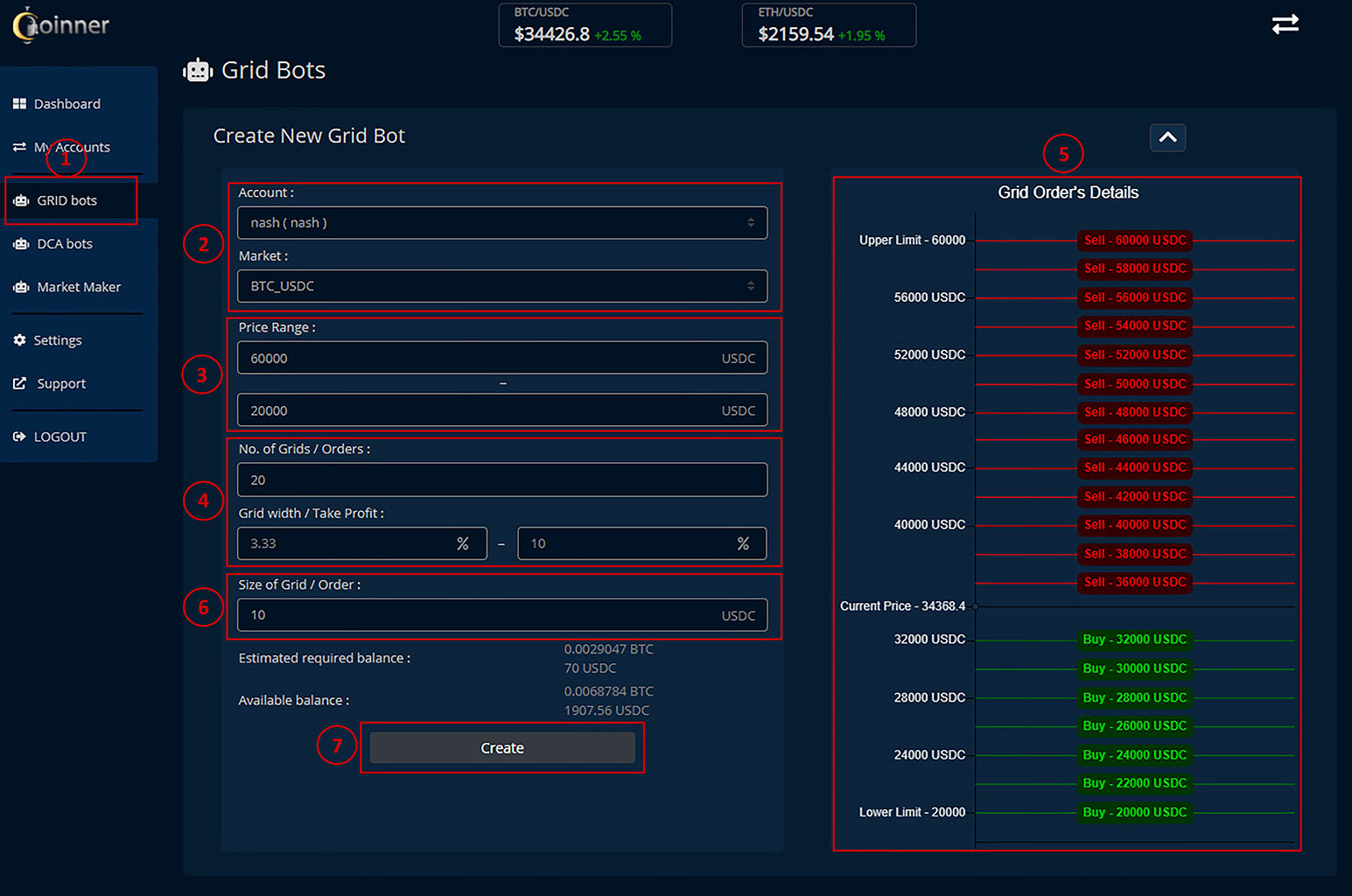

1. Go to the menu and select “Grid bots.”

2. Choose the "Account" to create the bot as well as the preferred market. For the market, it’s the cryptocurrency you want to trade and the base currency.

3. Specify the price range you would like to trade.

4. The next step is entering the grid levels and see Profit Per Trade.

5. A chart will preview current market price, price range, and the prices of grid orders' going to place.

6. Set grid size or the order size per grid

7. Click “Create,” and the bot configurations will be complete and bot created. A pop-up message will confirm successful bot creation, and in case of errors, you will be guided on how to fix it.

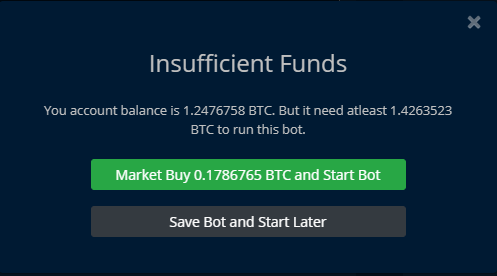

To start trading, you may have both base current and quote currency. For example, you can choose BTC/USDC. The Base Currency, in this case, is BTC, while USDC is the Quote Currency. If the only currency you have in the exchange wallet is USDC, this will pop up.

The first option is using the Grid Bot you’ve just created to purchase BTC automatically with a Market Order at the current exchange price.

The second option is buying the Base currency (BTC) yourself or manually and return to start the grid bot once the purchased coins are deposited into the exchange account. In that case, you just click ‘Save Bot and Start Later.’

Grid Bot Management

Now that you have the bot trading for you, it is important that you learn few things on how to manage it. Here 7 things you need to know for proper grid bots trading:

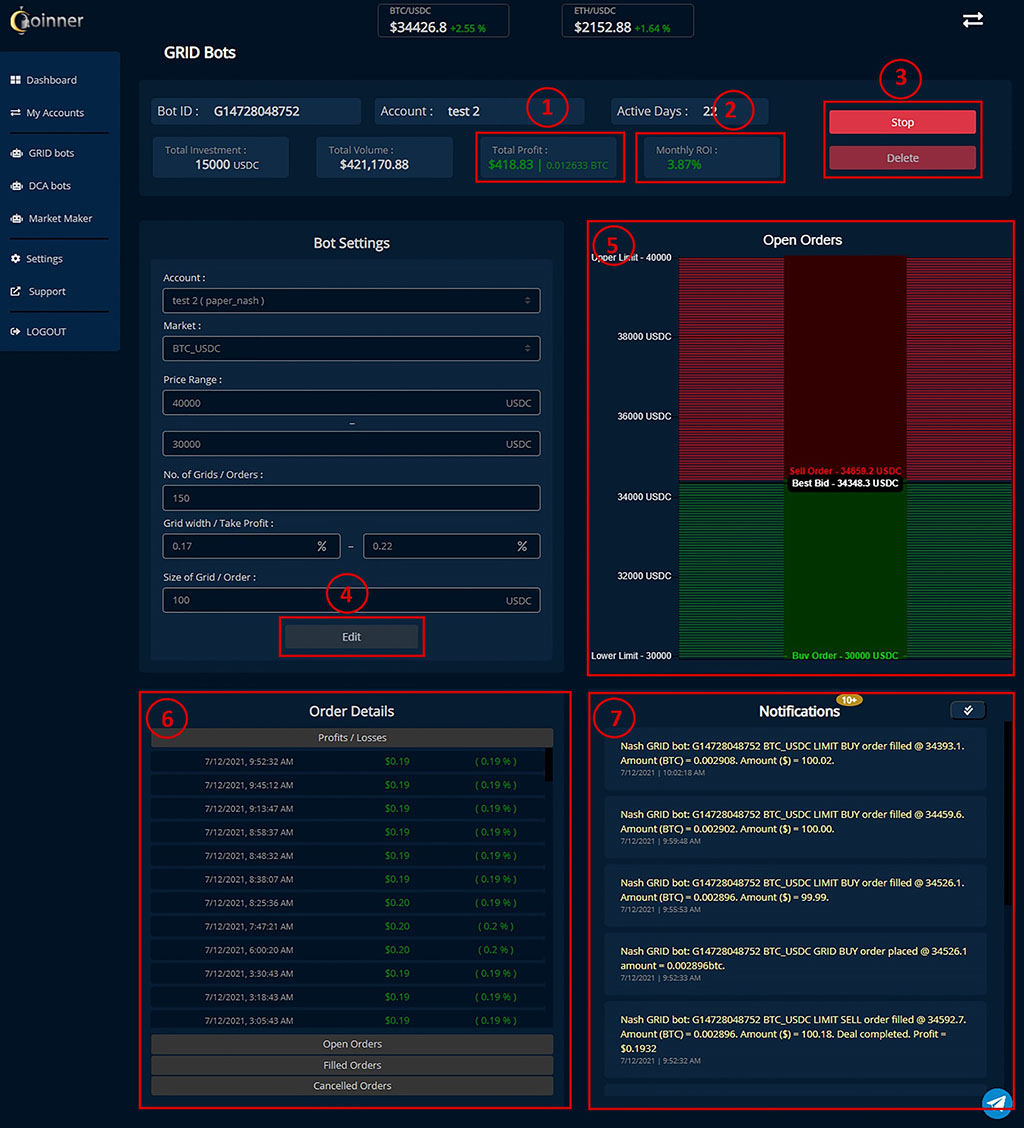

1. Display the Total Profit since the bot creation date.

2. Display the monthly ROI calculated based on past performances.

3. Grid Bot controls, Stop (pause) the Grid Bot, and delete the Grid Bot.

4. You can edit your bot settings anytime, but before that, you must stop it, and after editing, you should restart it.

5. A chart displaying currently open orders, best Bid price and best Ask price.

6. Order details - profits & losses, open orders, filled orders, and canceled orders.

7. Bot's notifications. (You can activate notifications through Telegram as well. To activate Telegram notifications head to Settings page and connect with Coinner Telegram Notification Bot.)

Now you know everything to start Grid trading in Coinner Platform.

Happy Trading !

Disclaimer: The contents of this article should not consider as financial advice. There is a high-risk associated with cryptocurrency trading. The user must do their own research before investing in cryptocurrencies.

FAQ

What happen if the price of the market exits the grid range ?

The bot will wait for the market to retun back to the grid range and then continue trading. You may need to wait until market return back to range or you can stop the bot and update it with new range and restart.

How much it cost ?

You don't need to pay any subscription fee to use Coinner platform. We are partner with Nash exchange and provide Free bots for nash users. Also Nash exchange have 0% maker trading fees so if you running a GRID bot in Nash exchange you don't have any trading fees as well.